2026 Solar Preview: The Biggest Turning Point of the Decade and Why Homeowners Are Turning to Solar Near Me

The solar industry is entering its biggest shift in years and 2026 is set to be the strongest year ever for residential solar, especially in Florida.

With the 30% Federal Investment Tax Credit (ITC) ending for homeowner-owned systems on December 31, 2025, many expected solar demand to crash. Instead, it’s skyrocketing, thanks to a new generation of lease-to-own and third-party-owned (TPO) solar programs that make going solar easier and more affordable than ever.

Here’s what homeowners need to know before going solar in 2026.

Most industries slow down when major incentives disappear; Solar is doing the opposite

Why? Because a NEW wave of financing, especially lease-to-own and third-party-owned (TPO) programs are rapidly sweeping Florida and other states, too. At Solar Near Me, we are positioned to help homeowners navigate this new landscape, offering ways to go solar even without the homeowner tax credit. Let’s break down what’s happening and why 2026 is predicted to be the biggest year yet for residential solar.

The Biggest Change of 2026: No More 30% Homeowner Tax Credit

For nearly two decades, the Federal Investment Tax Credit (ITC) powered the home solar boom. If you owned a solar system, you could apply for a 30% federal credit against your taxes. Starting in 2026, that option disappears for typical homeowners.

This means:

No more 30% credit on cash purchases.

No more 30% credit on homeowner-owned loans.

Out-of-pocket costs go WAY UP for buyers who want to own their system upfront and outright.

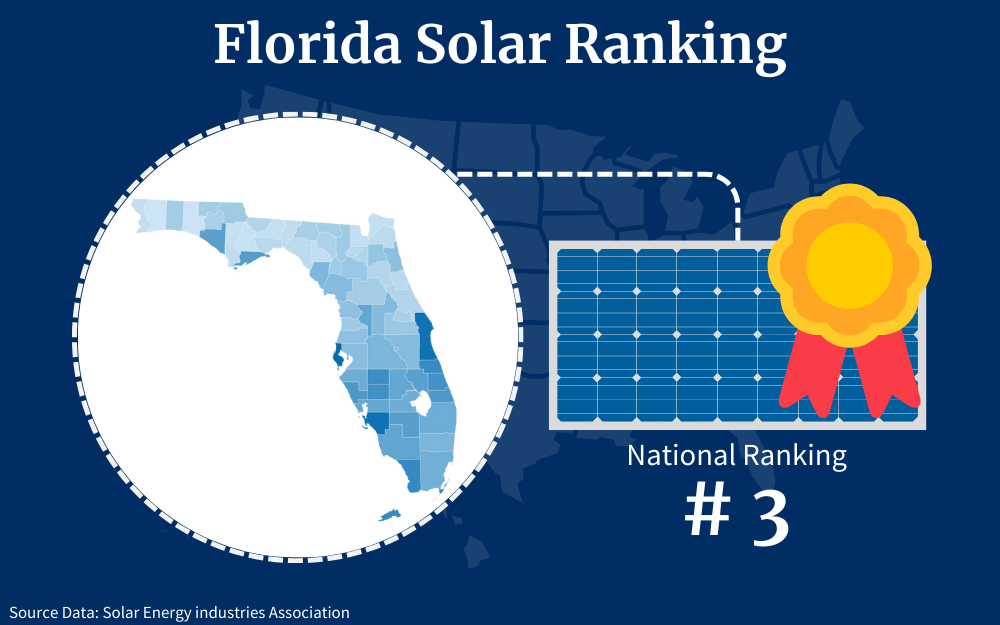

Florida Solar Installations Continue to Boom

Lease-to-Own & TPO Systems Are Surging: Here’s Why

Under the new federal rules, lease and lease-to-own systems STILL qualify for the federal tax credit, as long as the installer maintains ownership until the system is placed into service. This changes everything.

Why homeowners love the new lease programs:

$0 down options

Homeowners no longer need large upfront capital.

Fixed or predictable monthly payments

Avoid rising electricity rates and inflation.

No Tax Liability needed

You don’t need to owe federal taxes to benefit! The TPO company claims the tax credit and builds the savings directly into your payment.

Maintenance is included

Homeowners avoid risk; the provider handles monitoring, repairs and performance guarantees!

Super affordable for working families

Most homeowners simply want lower bills without the risk. Lease-to-own delivers exactly that.

Because of this, analysts expect 2026 to be one of the highest solar adoption years ever, especially in high-bill states like Florida.

FPL is one of SEVERAL Utilities to Propose MASSIVE Rate Hikes in 2026 (Billions of Dollars)

Why Lease-to-Own Is EVEN More Popular Than Traditional Leases

Traditional solar lease agreements lock homeowners in for 20-25 years with no ownership at the end. Lease-to-own is different.

Homeowners get:

Lower monthly payments upfront

The same warranty and maintenance coverage

The ability to OWN the system after the term (OR) buyout after a period of years

The chance to benefit from increased home value

It’s the best of both worlds:

LOW monthly cost today —> ownership tomorrow.

These programs EXPLODED in 2025 and are projected to dominate 2026-2027.

2026 Solar Market Forecast: What Experts Expect

Most homeowners will actually save more money using the lease or lease-to-own options going forward. Reasons for this are as follows:

The tax credit is baked into their payment

They avoid interest on loans

They avoid large down payments

They avoid system maintenance costs

They get immediate bill reduction

For millions of families, this is a BETTER FIT than owning.

Solar Near Me partners with national and regional installers to ensure homeowners get access to 2026-qualified TPO programs that still use the tax credit.

Why Go Solar Now?

Industry analysts project that there will be MASSIVE growth in Lease/TPO installations in 2026. With the homeowner tax credit gone, analysts expect a historic shift toward TPO programs as the “default” option. These are just a FEW of the reasons why homeowners are switching to solar to save money and protect their families:

Record-high electricity rates in the New Year

Grid modernization is a HUGE expense for utility companies

Fuel volatility

Weather-related grid investment

A homeowner making the switch to solar in 2026 is due to PREDICTABILITY. Electricity is a forever expense and solar is a LOCKED IN PRICE at a fraction of the retail utility rate.

Increase in Home value for Solar-owned homes

Homes with solar still sell for more! New home buyers can assume the lease and therefore a low, predictable power bill with their new house.

Solar Near Me is here to Help!

Final Takeaway: 2026 is the Year Solar Becomes MORE SIMPLE

While the tax credit is ending for homeowner-owned systems, it’s NOT the end of solar — It is the beginning of a new chapter!

Solar Near Me gives you:

⭐ Zero-down options that don’t require tax liability

Perfect for retirees, fixed-income households and workers who do not owe thousands in taxes.

⭐ Multiple installers + Multiple equipment options

Lease-to-own options from a range of financing partners

⭐ Lower monthly payments than your utility bill

Your solar replaces your RISING utility bill with something stable and consistent, cheaper from Day 1

⭐ Battery-ready programs

Grid outages continue to grow, especially with MASSIVE demand for electricity; homeowners want security.

In the new chapter of solar adoption, lease-to-own is the star. Solar Near Me is positioned to help homeowners take advantage of it seamlessly, affordably and with expert guidance.

Ready to See your 2026 Solar Options?

Solar Near Me has side-by-side comparisons; including lease-to-own, fixed-rate leases, batteries and multi-installer bids.

Call: 689-407-6813

Email: support@solarnearme.info